Secteurs porteurs

1. AGRIBUSINESS

- According to the Kenya Investment Authority report, 70% of the country’s exports have an agricultural focus, and the sector employs 85% of the rural workforce;

- Sectors such as agro-processing need more investors. Since the technology for processing agricultural products is underdeveloped, large volumes of harvest products go to waste due to limited processing options for perishable goods;

- There is a growing interest in the food industry. Great success of Art Caffe in Kenya;

- Belgian is the first destination in the world for Kenyan coffee beans;

- Young Africans are also going into the agricultural sector and are looking for investment partners. Most of these young people have either inherited land or have been allocated land by government as part of ongoing efforts to motivate Africa youth to go into farming;

- European food processing giant Cirio Alimentare is a majority shareholder of Del Monte Group. Delmonte is a Kenyan food processing company that operates in the cultivation, production, and canning of pineapple products. Kenya's largest single manufactured export is canned pineapple, and the country ranks among the top five pineapple exporters in the world.

2. ENERGY

In Kenya, energy is identified as one of the infrastructural enablers of the three pillars of Vision 2030. In order to promote renewable energy projects like wind and solar energy development program on a commercial scale, the Government of Kenya (GoK) has also introduced Feed-In Tariff (FIT) policy to attract private investments.

- The country’s agricultural activity produces large amounts of agricultural waste. These can be used to produce electricity by implementing biogas and biomass technologies. The 2014 National Energy Policy Draft also sets out biogas expansion targets of 10,000 small and medium-sized digesters by 2030. Biogas is considered a viable energy solution by a number of agricultural producers;

- It is expected that about 25% of the country will be suited to current wind technology. There is significant potential to use wind energy for wind farms connected to the grid, as well as for isolated grids and off-grid community electricity and water pumping. Kenya recently experienced a surge in wind energy installations for electricity generation. The largest windfarm in Africa (300 MW) is under construction in the Turkana area of north-western Kenya. The Ngong hills area close to Nairobi also has 5.1 MW installed and private investors plan to install several MW of capacity. An average of 80 - 100 small wind turbines (400 W) have been installed to date, often as part of a hybrid PV-wind system with battery storage;

- Kenya has high insolation rates, with an average of 5-7 peak sunshine hours and average daily insolation of 4-6 kWh/m2. The total potential for photovoltaic installations is estimated at 23,046 TWh/year. The government is aiming to install an additional 500 MW and 300,000 domestic solar systems by 2030. Commercial and industrial applications are also becoming increasingly important: flower and vegetable farms have already pioneered and installed captive renewable energy systems to contribute to the power supply on their premises;

- The potential for large-scale hydroelectric power development is estimated to be 1,500 MW, of which 1,310 MW is feasible for projects with a capacity of at least 30 MW. Of these, 434 MW has been identified in the Lake Victoria basin, 264 MW in the Rift Valley basin, 109 MW in the Athi River basin, 604 MW on Tana River basin and 146 MW on Ewaso Ngiro North River basin. However, the projected generation costs for these sites mean they are excluded from the Least Cost Power Development Plan. Small, mini and micro hydroelectric systems (with capacities of less than 10 MW) are estimated to generate 3,000 MW nationwide;

- Kenya is endowed with geothermal resources, mainly in the Rift Valley. Conservative estimates suggest geothermal potential in the Kenyan Rift at 2,000 MW, whereas the total national potential is put at between 7,000 and 10,000 MW. Yet geothermal development is a lengthy process in the best of scenarios, requiring several years from conception to commissioning;

- Frontier Energy is a Danish-based private equity firm. The company invests in renewable energy projects in sub-Saharan countries, focusing on Kenya, Uganda, Tanzania and Rwanda.

3. WATER TREATMENT

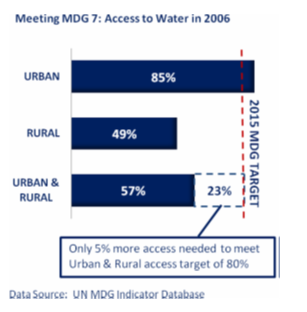

- Kenya is a water-scarce country with less than 1,000 m3 per capita of renewable freshwater supplies;

- 80 percent of Kenya is made up of arid and semiarid lands. Variability of rainfall in these areas ensures that local populations have limited socioeconomic opportunities.

4. INFORMATION & TECHNOLOGY (ICT)

- The Kenyan ICT market is estimated to be worth 717 million dollars by the end of 2019, with hardware accounting for nearly 60% of total ICT investment and the balance coming from ICT services. The Kenyan government has invested heavily in the sector. The ICT sector has benefited from forced automation (with a shift to home-based work and schooling), increased demand for internet data and increased e-commerce;

- The top ten internet-using countries in Africa: Kenya is nr 3 in Africa with 32 million consumers in 2017. By 2023, there will be over one billion mobile subscribers in Sub-Saharan Africa;

- It is estimated that digital technology could offer over 60 % of Africans access to banking services by 2025. About 90% of the population who would otherwise not have access to physical banks or ATMs could use mobile wallets for various transactions and remittance. These people could thus transact, save and manage their funds remotely on their mobile devices to financial security and credit building;

- The Ministry of ICT appointed a COVID-19 ICT Advisory Committee to seek partnerships with the private sector to provide innovative solutions in: Health, Food, Logistics/Transportation, Security;

- Cybersecurity: Within Africa, Interpol ranks Kenya as a country where transnational criminal organizations operate. Kenya has been under the spotlight of the U.S. Federal Bureau of Investigation (FBI) as a source of scams and destination of funds obtained through financial cyber fraud.

5. HEALTH

The Ministry of Health (MoH) has a well-defined eHealth strategy (2016-2030) that identifies five main areas of focus and implementation: Telemedicine, Health Information Systems, Citizen Information, mHealth: to pay my bill, schedule an appointment, send a message to my provider, access my lab results, find a physician and view my medical records; eLearning.

6. TRANSPORT

With the COVID-19 pandemic posing major challenges to Kenya's health systems, public health facilities and private hospitals will need solutions for logistics and transportation of essential drugs and tests, contact tracing applications, patient tracking and more.

7. CONSTRUCTION & INFRASTRUCTURE

- Kenya envisages a massive upgrading and extension of the country’s infrastructure. In this regard, the country has highlighted a number of infrastructure projects that present significant opportunities for investors in the coming years. The private investors can invest through public private partnerships;

- Kenya has an annual housing demand of 250,000 units with an estimated supply of 50,000 units, culminating in a housing deficit of 2 million units, or 80% deficit. Housing affordability is a key challenge in Kenya with many people unable to afford to buy or build their own home;

- Tatu City is a 5,000-acre, mixed-use development with homes, schools, offices, a shopping district, medical clinics, nature areas, a sport & entertainment complex and manufacturing area for more than 150,000 residents and tens of thousands of day visitors.

8. TOURISM

- Kenya aims to be among the top ten long - haul tourist destinations in the world offering high end, parse and distinctive visitor experience;

- Tourism is one of Kenya’s leading foreign exchange earner and third largest contributor to the GDP after agriculture and manufacturing;

- Opportunities that exist include development of resort cities, amusement parks, clubs, construction of Golf City, construction of international hotel chains and investment in conference facilities. Kenya currently has only one large international conference centre (KICC) with a capacity of 2,000 delegates in Nairobi.